招聘 | 高盛 内部审计 | 香港

- 2025-12-07 13:20:08

.png)

.png)

.png)

.png)

.png)

关注我们

岗位

高盛 - Internal Audit, Controllers & Tax, Analyst

Responsibilities

Requirements

Application Link

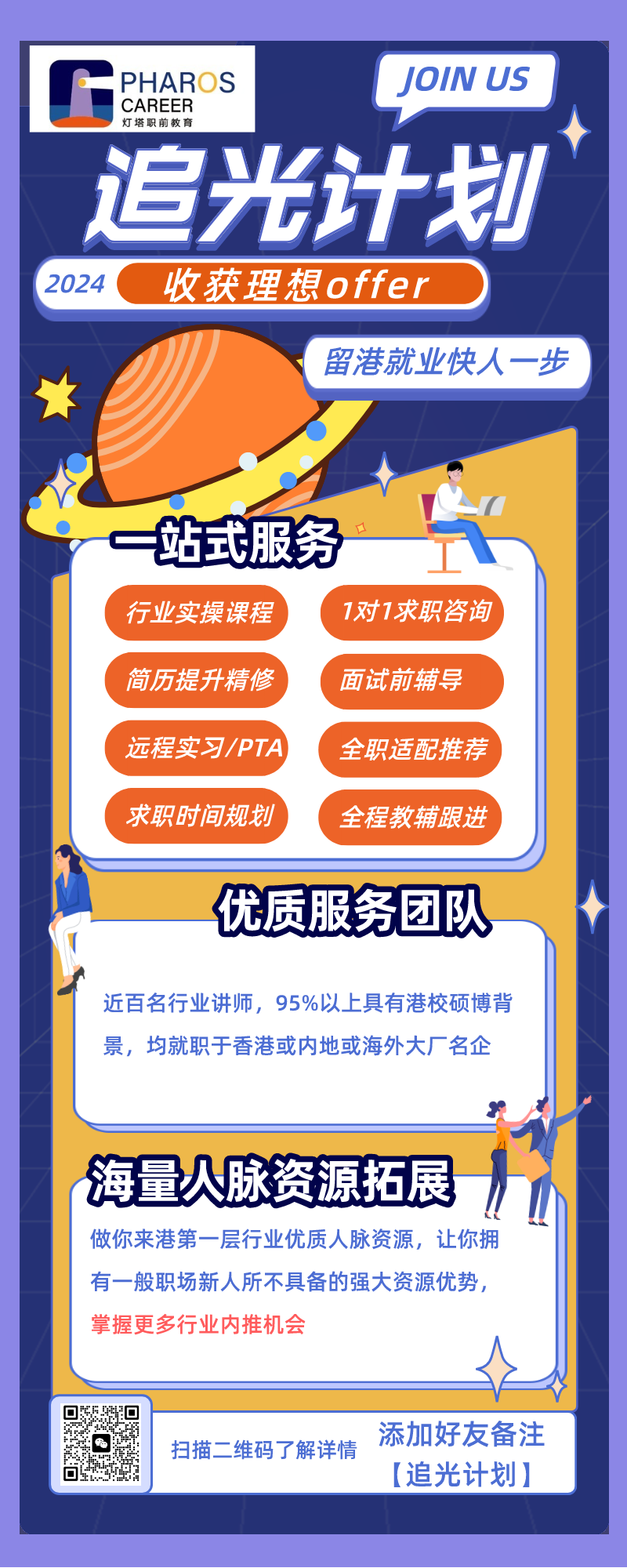

# 灯塔服务简介 #

最近内推岗位

硬核内推,助你求职起飞!

最近招聘信息发布

每天发布招聘信息,赶紧关注我们吧!

最近干货分享

学长学姐有话说|作为就业困难的文科女生,终于拿到了心仪的offer

学长学姐有话说|二本学姐一个月内跨专业逆袭斩获3个上市公司offer

每周干货,求职之路装备满满!

最近活动回顾

Career Coffee Chat回顾分享(005期)|香港教师的工资有多香?

Career Coffee Chat回顾分享(006期)| IT专业要做研究?学姐告诉你那可不一定

Career Coffee Chat回顾分享(007期)|在港央企私募大佬 保姆级求职指导

Career Coffee Chat回顾分享(008期)| 毕业不一定直接就业,继续深造也是生涯规划的另一方向?

各类贴地经验分享会,师兄师姐们带你飞!

扫码关注我们

Pharos Career

让求职之路 更 加 清 晰!

.png)

.png)

.png)

.png)

.png)

本文来自网友投稿或网络内容,如有侵犯您的权益请联系我们删除,联系邮箱:wyl860211@qq.com 。